A full year of email newsletters! Thank you all for the readership, support, feedback, and opportunities to discuss the industry I am so passionate about with so many of you. Read on for an in depth presentation of deal activity and a spreadsheet of the day-tuh. And if you’re in Miami for BattleFin, text me or stop by Ocean Social to say hi!

M&A

In 2023 there were 164 highlighted M&A transactions. Shout to the top acquirers, who remain the same from the Mid-Year Review.

Snowflake (6): LeapYear, Myst, Neeva, Ponder, Samooha, SnowConvert

Databricks (4): Arcion, bit.io, MosaicML, Okera

Accenture (4): Green Domus, Nextira, Redkite, Strongbow Consulting

S&P Global (3): ChartIQ, Market Scan, SCRIPTS Asia

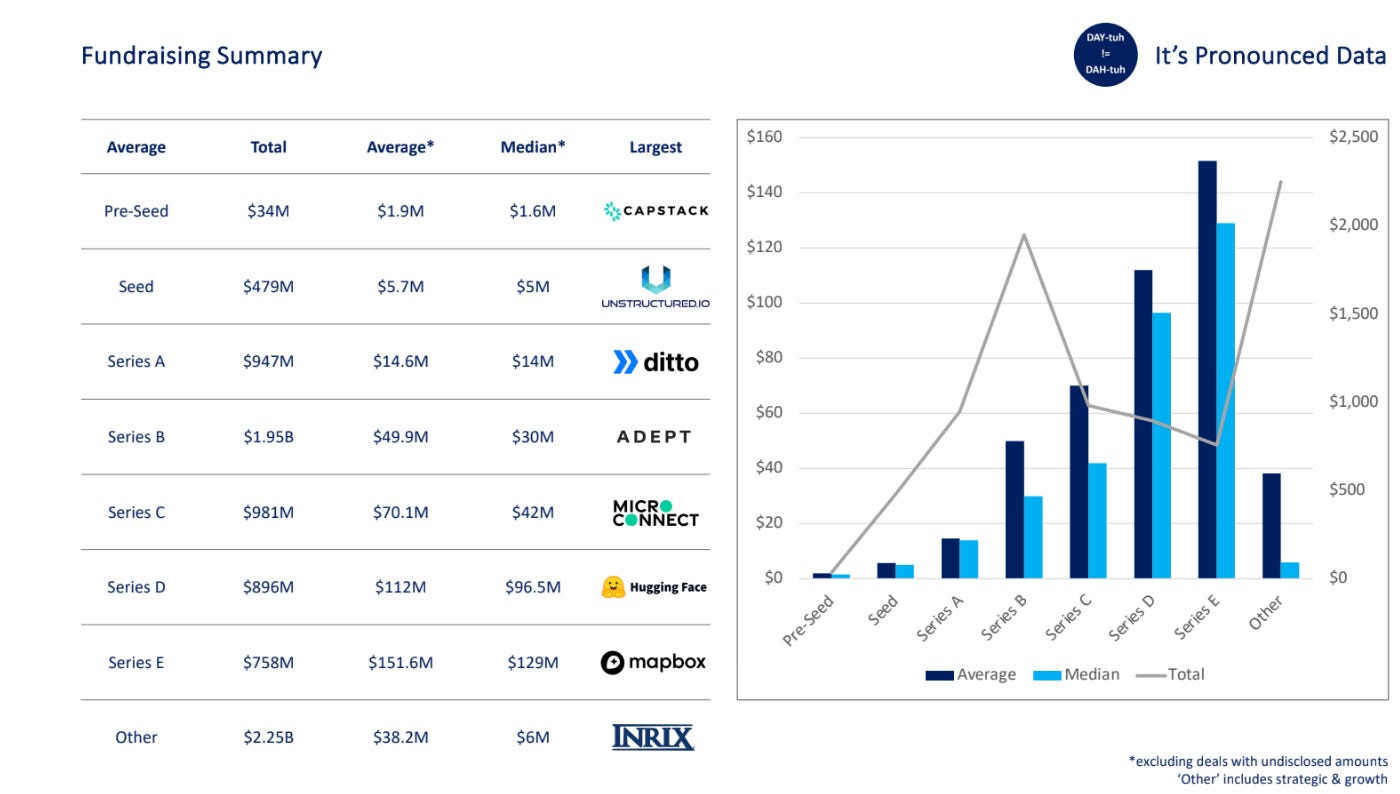

Fundraising

In 2023, we highlighted 345 funding rounds with an average round size of $28.4M and median $11.3M (only including those disclosing amount raised). Shoutout to some top lead investors

Citi (5): Built Technologies, InfluxData, Securiti, Transcend, Virtualitics

General Catalyst (5): Adept, Chalk, Expanso, Medeloop, Modular

Andreessen Horowitz (4): Coactive, Lightup, Moment, Pinecone

Google (4): AlphaSense, Anthropic, Chronosphere, Range

Paid subscribers read on for the full details and slides like this…

Not a paid subscriber, check out the trial link below. You were going to put it on your corporate card anyway!